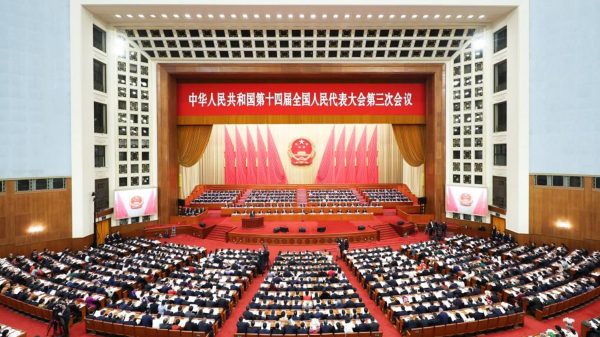

The global technology landscape has witnessed numerous controversies and debates, and one of the most contentious issues in recent years revolves around the 5G restrictions and bans on Chinese telecom manufacturers in the European Union (EU).

While concerns about national security and data privacy are crucial, it is essential to examine the fairness of this ban when compared to the treatment of foreign companies, such as Nokia and Ericsson, in China. This article aims to shed light on the perceived unfairness of policy restrictions on Chinese telecom manufacturers including Huawei and ZTE in the EU and the contrasting treatment of Nokia and Ericsson in China.

The policy restrictions on Chinese telecom manufacturers in the EU:

The EU’s decision to ban or restrict Huawei and ZTE from participating in the development of 5G networks in member states was based on so-called security concerns. Huawei and ZTE’s alleged ties to the Chinese government raised apprehensions about potential backdoors and espionage activities. While the need to safeguard national security is paramount, it is crucial to evaluate the evidence and ensure that all companies are treated fairly and transparently.

So far, there is no evidence showing Chinese telecom manufacturers produce any cybersecurity loopholes, or backdoors, in any European member states they operate in the past 2-plus decades. Imposing political judgement over technical issues will not only provide wrong messages to telecom professionals in reinforcing cybersecurity protection, it’s also a recipe to start an unnecessary trade war with China, the world’s second-biggest economy.

From a European market perspective, after consistent policy restrictions and other limitations, the number of Huawei 5G stations in Europe has dropped far below what Ericsson and Nokia have in the Chinese telecom markets.

According to data from Dell O’ro (an industrial consulting firm), Ericsson’s 5G incomes from China’s market (2020-2022) were higher than Huawei’s incomes from the European market.

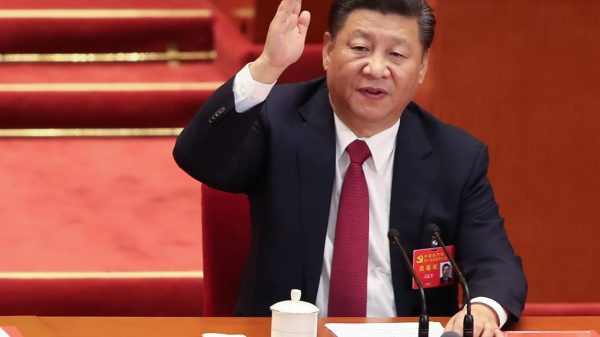

China’s Treatment of Nokia and Ericsson:

On the other side of the spectrum, China has not banned companies like Nokia and Ericsson from operating within its borders. This disparity raises questions about equal treatment and fairness in trade relations. While there may be justifiable reasons for scrutiny, it is important to ensure that any restrictions imposed are consistent and based on verifiable evidence.

China has no limitation on Ericsson and Nokia’s core networks. Both companies deploy core networks in more than 25% of China’s provinces, including areas close to military bases. While in Europe, Chinese telecom manufacturers are almost banned in all EU markets for core networks, and their core network market shares dropped to nearly Zero in Europe.

During the 2023-2024 China telecom operators’ purchasing period, Ericsson and Nokia are expected to gain 16.3% of market share, a big increase from the years before. By the end of this purchasing cycle, European telecom manufacturers will have more 5G stations in China than they combined in Europe. They sell more in China than in their home markets.

Economic Impact:

The policy restrictions on Chinese telecom manufacturers in the EU have significant economic implications for the companies and the European market. Huawei and ZTE have been major players in the telecommunications industry, providing competitive products and solutions. Banning them limits competition and potentially restricts consumer choice. Additionally, European telecom operators may face delays and increased costs by tens of billions of Euros when seeking alternatives. And guess what, it eventually be ordinary telecom customers, namely you and me, to foot the bill.

It’s worth mentioning that three European countries including Sweden, Romania and Belgium were ranked at the bottom of 5G coverage after banning Huawei, according to reports from the European 5G Observatory.

According to DESI Index’s Connectivity Indicator ranking, Sweden dropped to 9th in 2022 from 2nd place in 2020; Romania dropped to 15th from 11th, while Belgium dropped to the last place from previously 13th.

Reciprocity and Fair-Trade Practices:

The lack of reciprocity in trade relations between the EU and China is another issue that highlights the perceived unfairness of the Chinese manufacturers’ restrictions. If the EU imposes restrictions on Huawei and ZTE based on security concerns, it is only fair to expect a similar level of scrutiny and restrictions on European companies operating within China. Failing to ensure fair trade practices undermines the principles of open markets and equal treatment.

To make my point, I want to quote a line from John Van Fleet, adjunct faculty at the Antai College of Economics & Management, Shanghai Jiao Tong University, a long-time researcher of China’s socioeconomic development: “We can see from history that tariffs or other kinds of barriers might look like walls of protection, but they can wind up being prisons.”

Conclusion:

The ban on Huawei and ZTE in the EU, while motivated by security concerns, has sparked debates regarding fairness, evidence, and reciprocity in international trade relations. While national security is undoubtedly of paramount importance, it is essential to ensure that bans are based on concrete evidence and are consistently applied to all companies.

I would like to quote Boy Luthje, Senior Research Fellow at the Frankfurt Institute of Social Research to make a point here. “The biggest risk here, especially in the field of 5G, has been the permanent under-investment by European telecommunications operators, governments and related industrial actors into the expansion of the infrastructure.”

“This risk of under-development can only be addressed in cooperation with Chinese suppliers and technology vendors rather than by declaring them ‘high risk’.”

The contrasting treatment of Nokia and Ericsson in China raises concerns about unequal treatment and highlights the need for fair and transparent trade practices. Moving forward, it is crucial for governments and regulatory bodies to uphold principles of fairness and ensure that decisions are grounded in evidence to maintain trust and promote an open and competitive global technology market.

Overall, China opens a larger and bigger market to European telecom manufacturers and has no policy restrictions at all, while the EU is shutting up the operations of Huawei and ZTE with various policy restrictions. For telecom to be competitive, energetic, low cost and innovative, shutting Chinese manufacturers out of the EU market is hurting healthy market competition, limiting innovation and dragging down Europe’s digital transition. It’s especially hurtful to pedantry consumers who would have to bear higher costs for telecommunication services.