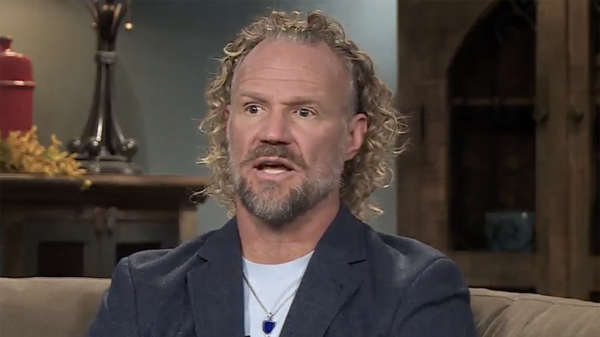

Fintech startups are companies that offer innovative solutions to optimize financial services and solutions. The term “fintech” reflects the intersection of finance and technology in the activities of such companies, Sergey Kondratenko explains.

Fintech startups are looking to improve traditional financial systems by leveraging advances in areas such as mobile apps, data analytics, artificial intelligence, blockchain, cloud computing, and more. They are focused on providing financial services in a more efficient, convenient and cost-effective way.

Sergey Kondratenko is a recognized specialist in a wide range of e-commerce services with experience for many years. Now, Sergey is the owner and leader of a group of companies engaged not only in different segments of e-commerce, but also successfully operating in different jurisdictions, represented on all continents of the world. The main goal is to drive new traffic, create and deliver an online experience that will endear users to the brand, and turn visitors into customers while maximizing overall profitability of the online business.

Overview of the current situation in the field of innovative financial solutions

The startup is focused on innovation that has never been brought to market before. It could be a product or service, a technology, a process, a brand, or even a new business model.

One of the key goals of a startup is to find out if there is a need for its product, Sergey Kondratenko explained. According to him, startups are trying to find and optimize the target market for a new solution. Here are examples of successful modern startups, which are in the top ten trends in 2023.

● Klarna is a Swedish fintech company providing buy now, pay later (BNPL) services. It has over 80 million users and is one of the most popular BNPL providers in the world.

● Stripe is an Irish-American payment company providing payment processing services to businesses of all sizes. It is one of the most popular payment processors in the world, having raised over $9 billion.

● Robinhood is an American investment platform that allows you to trade stocks, options and cryptocurrencies without commission. It has over 20 million users and is one of the most popular investment platforms in the world.

● SoFi is an American financial technology company that provides personal and mortgage loans, student loans, and other financial products. It has over 2 million users and is one of the largest fintech companies in the US.

● Chime is an American financial technology company offering checking and savings accounts and other financial products. With over 10 million members, it is one of the fastest-growing fintech companies in the US.

Application of technologies in various financial products and services – Sergey Kondratenko

The priority task of fintech startups is to use technology to make financial processes more efficient, accessible, and inclusive for individuals and businesses. Here are some examples of various financial services and solutions that, according to Sergey Kondratenko, are the most relevant for fintech startups.

1. Digital payments. Fintech companies can offer mobile payment apps, online gateways, peer-to-peer payment platforms, and digital wallets for seamless and convenient transactions.

2. Online lending and crowdfunding. Fintech startups can offer online lending platforms that connect borrowers with potential lenders. Crowdfunding platforms help pool funds from various individuals to fund projects.

3. Personal finance and wealth management. Fintech startups often develop apps and platforms that help people manage their finances, track expenses, budget effectively, and make informed investment decisions. They can use algorithms and robo-advisers to provide customized financial advice.

4. Insurance technologies (Insurtech). Some fintech startups are aiming to improve insurance processes by using technology for claims processing, underwriting, risk assessment and customer interaction. They can use data analytics and artificial intelligence algorithms to optimize insurance operations.

5. Digital banking. Fintech companies can offer online banking services, allowing customers to access their accounts, money transfers and other banking services through web or mobile applications. They can also develop virtual banking solutions.

6. Cryptocurrencies and blockchain. Fintech startups can use blockchain technology and cryptocurrencies to provide secure and decentralized transactions, develop digital currencies, or create entire platforms for trading cryptocurrencies.

Sergey Kondratenko on the benefits of investing in fintech startups

A startup is a business whose team develops a new product and raises funds for its implementation. At the same time, investments in fintech startups can provide a number of potential benefits, says Sergey Kondratenko.

Here are some of the key benefits of such investments:

● Growth potential. Fintech startups often operate in fast-growing and disruptive sectors of the financial industry. By investing in promising companies at an early stage, investors are able to take advantage of their growth potential. If a fintech startup successfully disrupts traditional financial services or introduces innovative solutions, it could lead to a return on investment in the long run.

● Innovation. Fintech startups are using modern trends such as artificial intelligence, blockchain, mobile applications and data analytics to create new, more efficient financial products and services. By investing in fintech startups, you can join these innovative technologies and gain long-term competitive advantages.

● Diversification. Investing in fintech startups can be one of the ways to diversify your investment portfolio. Fintech covers various sub-sectors, including payments, lending, wealth management, insurance, etc. By investing in fintech startups in different sectors and geographies, there is an opportunity to diversify risks and reap potential rewards.

● Access to untapped markets. Fintech startups often target underserved or underutilized market segments that have been overlooked by traditional financial institutions. Investing in such companies opens up access to new markets and customer segments that have the potential for significant growth.

● Efficiency and cost reduction. As a rule, fintech startups are aimed at streamlining financial processes, reducing inefficiencies and reducing costs. Investors in such companies may benefit from their ability to offer more cost-effective solutions than traditional financial institutions. Fintech innovations such as digital payments, online lending, and automated wealth management platforms are driving efficiencies and reducing operating costs.

● Market disintermediation. Fintech startups can become intermediaries between the consumer and the enterprise. The result can be cost reduction, increased access to financial services and increased transparency.

Sergey Kondratenko on the risks of investing in fintech startups

Investing in startups can be an attractive opportunity, but like any other investment, it comes with certain risks.

Sergey Kondratenko draws attention to the fact that investments in start-ups are called venture investments – these are investments in businesses with a high degree of risk. As writes Forbes, 80% of companies where venture capital investors have invested, as a rule, will fail.

Common risks associated with investing in fintech startups:

1. Market risk. Fintech startups operate in a highly competitive market. Changes in market conditions, regulatory frameworks or customer behaviour can affect the growth and profitability of a fintech startup.

2. Technological risk. Fintech companies rely heavily on technology to provide their services. There is a risk of technology failures, cybersecurity breaches, and scalability and performance issues. A startup that fails to adequately respond to these risks can face significant setbacks.

3. Regulatory Risk. Changes in regulations or compliance requirements can have a significant impact on a startup’s operations, cost structure, and ability to offer its products or services.

4. financial risk. Many fintech startups operate in a cash-strapped environment and require significant investment to develop their technology, attract customers, and achieve profitability. Lack of sufficient funding, failure to raise additional capital, or mismanagement of funds can pose a financial risk to investors.

5. Execution risk. The success of a fintech startup largely depends on its ability to effectively execute its business plan, otherwise the company will face failure.

6. Competitive Risk. Fintech is a rapidly growing industry with fierce competition. Startups face the risk of being overwhelmed or destroyed by existing financial institutions as well as new market entrants.

7. Operational risk. Startups need to establish robust operational processes, including customer acceptance, transaction processing, and risk management. Otherwise, interruptions in the operation of systems, services or data leakage can cause reputational damage, lead to the loss of customers and finances.

To assess and mitigate these risks, Sergey Kondratenko recommends that investors conduct a thorough due diligence (verification): evaluate the startup’s business model, its team, financial performance, competitive environment and market potential. Diversifying investments into multiple fintech startups will also help mitigate the risks of individual companies.