Bulgaria’s Prime Minister will address MEPs on Wednesday in Strasbourg. Prime Minister Denkov is set to outline his views on the challenges facing Europe and its future. One issue that he could address is an extraordinary agreement made under a previous Bulgarian administration that undermines EU energy sovereignty – writes Dick Roache

The Botas – Bulgargaz agreement which was negotiated by two state-owned enterprises without EU input, advantages Russia and Turkey, opens a gateway into the EU for rebranded Russian gas, tramples on EU principles, and significantly undermines EU ‘energy sovereignty’.

The Background

On 3rd January the Bulgarian state-owned Bulgargaz and its sister company Bukgartransgaz signed an agreement with their Turkish state-owned counterpart BOTAS.

The agreement was signed less than a month before the fifth Bulgarian General Election in two years. The deal was praised by the then Bulgarian Energy Minister, Rosen Hristov. Minister Hristov said the agreement solved a problem for Bulgaria by giving it access to Turkish infrastructure needed to upload liquefied natural gas allowing Bulgaria to buy gas from all international producers.

The Turkish Minister praised the deal as allowing Bulgaria to transport about 1.5 billion cubic meters of gas a year, helping to increase security of supplies in south-eastern Europe.

While neither Minister went into the question of the source of the gas covered by the agreement in detail, a matter of some importance for an EU Member State, Reuters reported Minister Hristov as commenting that while Bulgaria could not control the gas that would enter his country’s gas transmission lines would make sure it signs deals for LNG deliveries that are not from Russia.”

Background of the deal

The explanations given by the two Ministers when the BOTAS-Bulgargaz agreement was ‘signed off’ significantly downplay its significance.

The context in which the agreement was negotiated is important in understanding its importance.

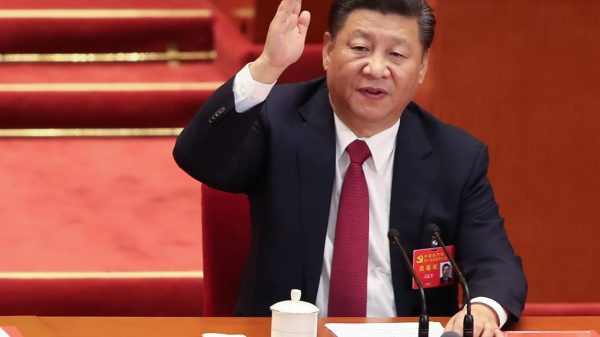

In 2022 President Putin Spoke openly about his ambition to turn Turkey into a Russian gas hub for Europe. The Russian President viewed a gas hub in Turkey as the best way to compensate for gas transit capacity last with the closure of the Nord Stream pipelines.

President Erdogan enthusiastically endorsed the idea suggesting that Trace which borders Bulgaria and Greece would be the ideal location for the hub. The Turkish President also promoted Turkey’s state-owned BOTAS as the ideal partner to provide the interconnectors needed to service a Russian hub.

An AP report in October 2022, recorded President Erdogan as confirming that the Turkish authorities and their Russian counterparts had been instructed to “immediately begin technical work on the Russian proposal”. In the same report, the Turkish Foreign Minister was clear that the Russian hub was intended to facilitate the movement of Russian gas “to European countries that want it because they no longer consider Nord Stream 1 and 2 to be reliable conduits”.

Rebranding Russian Gas and Undermining EU “Energy Sovereignty”.

The Trace gas hub when operational will do more than provide a replacement for transit capacity that Russia lost with the closure of the Nord Stream pipelines, it will also provide Russia with the perfect ‘workaround’ to undermine any EU ambition to wean itself off Russian fossil fuels post 2027.

The new hub will be an effective ‘laundromat’ where gas from Russia, can be mixed with gas from other producer nations -including potentially other sanctioned producers- rebranded as “Turkish gas” and then pumped onwards into Europe.

Turkey will also be a major beneficiary. When Trace Hub becomes operational Turkey expects to derive significant income from its operation. The state-owned BOTAS will be a beneficiary: more business more potential profit.

In addition to the significant financial benefits that the new hub can deliver to Turkey, it will also provide Turkey with an important political lever for use in its dealings with the EU. The hub will make Turkey a critically important ‘gatekeeper’ for EU gas imports.

The BOTAS- Bulgargaz agreement will be critical to the operation of the Trace gas hub providing the critical link for the gas processed there to move into EU gas networks.

Bad for Bulgaria

The full details of the BOTAS -Bulgargaz agreement have still to be made public. The details that are available suggest that the arrangements deliver limited tangible benefits to Bulgaria – as opposed to Bulgargaz -and could in fact cost the country dearly.

The agreement provides that the entire capacity at the key interconnection point between the Bulgarian and the Turkish gas transmission networks is exclusively reserved for BOTAS and Bulgargaz.

Private Bulgarian operators will not be able to book capacity, meaning that a Bulgargaz competitor wishing to import LNG via Turkish terminals will not be allowed to do so.

In addition to contradicting the selling point made by Bulgarian Energy Minister, Rosen Hristov when the deal was signed the discriminatory access to transmission capacity in the deal is a further example of how Bulgargaz uses every opportunity to hinder competition in the Bulgarian market.

The deal provides Bulgargaz with the capacity to import 1.85 million cubic metres of gas per year through the key interconnector point for which it will be required to pay an annual service fee of € 2 billion to BOTAS. The fee must be paid in full whether Bulgargaz uses the full capacity or not. In addition to potentially seeing Bulgargaz and its customers saddled with a very hefty bill this requirement will provide the state-owned enterprise which is notoriously hostile to private sector competition with an additional incentive for anti-competitive behaviour.

The agreement provides BOTAS with access to Bulgarian pipelines, for which a €138 million annual fee will be charged. It will also allow the Turkish operator to sell gas to consumers in Bulgaria and in neighbouring countries, a concession seen by many as ironic given Bulgargaz’s hostility to homegrown competition in Bulgaria.

Opposition to the Deal

From the outset, EU energy traders have flagged concerns about the BOTAS- Bulgargaz deal. Objections have been flagged about the preferential position the deal grants to Bulgargaz. Concerns have been raised that the discriminatory access to transmission capacity, a central part of the deal, will further hinder competition in the already constrained Bulgarian gas market. The European Commission has been called on by gas traders to indicate whether the agreement aligns with EU market principles.

The Bulgarian government that took office on 6th June has also made it clear that it has serious misgivings.

Shortly after taking office Prime Minister Nikolay Denkov called the agreement “non-transparent and unprofitable”. Energy Minister Rumen Radev, the successor to Rosen Hristov took a radically different view of the BOTAS-Bulgargaz agreement than his predecessor. Where Hristov had portrayed the agreement as addressing a problem relating to an infrastructure deficit that impeded LNG imports Minister Radev saw it as potentially costing Bulgaria billions without delivering any benefit.

In early August the Bulgarian Government indicated that the agreement with BOTAS would be investigated as part of a review of the policies of the technical Government that preceded it.

In October the Denkov administration announced that it was introducing a €10 per megawatt-hour tax on Russian gas transmitted across Bulgarian territory.

The new tax has been described by Bulgarian officials as making it less profitable for Gazprom to ship gas via Bulgaria, helping to reduce EU dependence on Russian fossil fuels, and forcing European countries to switch to alternative energy sources.

Difficulties in identifying the country of origin of the gas that will pass through the gas ‘laundromat’ being established at Trace could frustrate these aspirations. Given that problem, some see the new tax as an attempt to reverse the reputational damage done to Bulgaria in the eyes of EU partners by the BOTAS-Bulgargaz agreement rather than a solution to the problems that the agreement creates.

The European Commission has also indicated that it also intends to launch an examination into the BOTAS -Bulgargaz agreement.

This is not the first time that Bulgargaz has been in the Commission’s sights. Improvements that have resulted from previous interventions have been quickly reversed not least because of the high level of political support that Bulgargaz has always been able to count on.

Whether Bulgargaz by signing on to an agreement that could cost Bulgaria has crossed a red line undermining the domestic political support that it has historically enjoyed remains to be seen remains to be seen. What is certain is that the multiple flaws within the BOTAS-Bulgargaz agreement, the open support it gives to Russia to work around a strategic EU objective, the leverage that it gives Turkey to influence EU policy, and the open contempt for EU principles that it reflects gives the Commission a ‘stronger hand’ than it has enjoyed on previous occasions. It will be interesting to see how the Commission uses that hand.

Dick Roche is a former Irish Minister for European Affairs and a former Minister for the Environment.