The recent sale of the Bulgarian refinery, Neftochim Burgas, by Russian energy giant Lukoil to the Qatari-owned Oryx Group has garnered significant attention across industry and diplomatic channels. The deal, underlined by its geopolitical implications, spotlights both the intricate dynamics of global energy sales and the alleged past controversies surrounding Oryx’s principal, Ghanim bin Saad al Saad, who is no stranger to high-stakes international deals and allegations of illicit influence.

A New Chapter for Bulgaria’s Oil Market?

Bulgaria’s largest refinery, Neftochim Burgas, is a significant asset in the region’s energy landscape. As one of the largest refineries in Southeast Europe, its transition from Lukoil to Oryx’s control marks a shift with notable implications. The refinery has been a critical supplier of fuel for the Bulgarian market and beyond, servicing the Balkans and parts of Central and Eastern Europe.

Following increased Western sanctions on Russian companies, Lukoil’s exit aligns with a broader trend of Russian divestment across Europe, particularly in sensitive sectors like energy. However, the sale to Oryx, whose ownership traces back to influential figures in Qatar, brings a different type of scrutiny, especially given the global spotlight on Ghanim bin Saad al Saad’s alleged controversial business dealings.

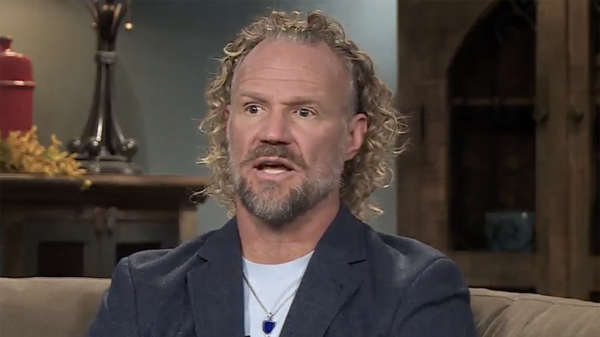

Oryx and Ghanim bin Saad al Saad’s FIFA Scandal

Ghanim bin Saad al Saad, the principal behind Oryx, became widely known after revelations that he allegedly paid $22 million in bribes to Brazilian FIFA representative Ricardo Teixeira to support Qatar’s 2022 World Cup bid. This scandal raised eyebrows worldwide and sparked broader concerns about the ethics behind Qatar’s successful push to host the prestigious tournament.

The 2022 World Cup bid was already shadowed by allegations of corruption and misconduct, and allegations of such substantial bribes reinforced suspicions. The $22 million payment by al Saad, alleged to have influenced Teixeira’s vote, drew parallels with other high-profile bribery cases that have plagued international sporting bodies, diminishing trust in FIFA’s bidding process. This incident, widely scrutinized as emblematic of unethical lobbying, bears a resemblance to the recent “Qatar Gate” scandal, in which members of the European Parliament were accused of accepting bribes from Qatari officials to influence policy.

Echoes of Qatar Gate in European Energy?

The acquisition of the Bulgarian refinery by a Qatari-linked entity sparks discussion on whether the energy sector might now be influenced in ways akin to the political dynamics seen in the Qatar Gate incident. The concern is whether Qatar’s growing influence in strategic industries across Europe could potentially bypass regulatory scrutiny or ethical considerations through the same controversial channels that have marred its other pursuits.

Ghanim bin Saad al Saad’s alleged history in global business transactions, combined with Qatar’s deep financial involvement in critical European sectors, raises questions about transparency and regulatory oversight. Energy security in Europe has been a critical focus of EU policy, especially in light of Russia’s waning influence and the continent’s push for diversified and reliable energy sources. Oryx’s acquisition of Neftochim Burgas falls within this context, yet the deal brings questions about how foreign influence can permeate such a sensitive domain under the guise of investment.

Looking Ahead: Europe’s Balancing Act

This deal signifies Europe’s increasingly complex relationship with external stakeholders in its essential industries. While the immediate advantages of investment may bolster local economies, the longer-term ramifications—especially when linked with figures of controversial reputations—merit closer examination.

As Europe continues its path toward strategic autonomy, the entry of Oryx and its alleged association with Ghanim bin Saad al Saad demands an honest assessment. The sale is not just about energy—it is a reflection of the ongoing need to navigate global financial ties while safeguarding transparency and integrity. In doing so, Europe may yet find ways to protect its vital sectors from the potential pitfalls of unchecked influence, much like those exposed in the world of international sports and politics.